Newsletter: March 2022 – Point of Sale

| Thank you for Signing Up |

March 2022

INSTANT ACCEPT FEATURE OF THE MONTH

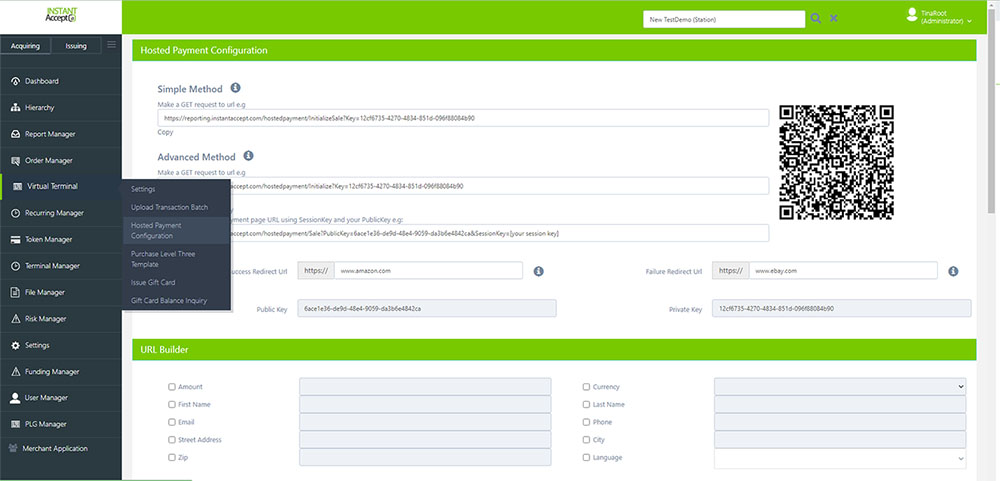

Instant Accept and QuickBooks Point of Sale

With Instant Accept and Point of Sale from QuickBooks you will have more flexibility to accept all forms of payments whether in a store front or on the go. Giving you more opportunities to grow you business and revenue. This month we will delve into Instant Accept and QuickBooks Point of Sale in a little more detail. We will cover how Point of Sale works, some of the functions that are available, security, features and benefits.

INSTANT ACCEPT TIPS, TRICKS & TOOLS

Down Payments and Point of Sale

2022 Payment Trends for Businesses

Payment trends for 2022 have changed but some have remained the same or had a small change. One of the biggest changes to come will be paper checks. Especially due to COVID, more payments are being made by a payment card rather than paper checks. Consumers have reduced their paper check use by over 10% in the last few years.

Working from home has also become a big focus, especially in the payments arena. CPA Practice Advisor states 2022 brings the biggest list of challenges for CFOs and finance managers than ever before. Find out more about how your business could be affected or how you can help your business succeed.

Struggling to keep your books balanced?

Secrets to Help Grow and Improve Business

Finding it difficult lately to come up with ideas on how to improve business growth or just your overall business performance? In this article from Business News Daily they have built a list of tips from founders of startup companies. Businesses are starting to get back into their normal routines pre COVID-19 and improving their businesses post COVID and some are struggling more than ever.

Within these tips you’ll find they address revenue sources, staff, risks, customer experience and so much more. We hope that these tips can help you or inspire you to get yourself and or your company moving in the right direction.

KEY FEATURES OF INSTANT ACCEPT

WE WOULD LOVE YOUR FEEDBACK

- Choose ANY Processor

- Accept Multiple Forms of Payments

- Work Within One User Interface

- Gateway Sync

- Multi-store Locations, Websites and Devices

- Create and Email Invoices

- Purchase Card Level 2 & 3

- Tokenization

- Recurring Payments

- Convenience Fees

- Protect Core Data

- PCI Level 1 Certified

Click the button and send us a review. If it’s anything below 5 stars contact us so we can work to resolve any issues you may be having.

HELPFUL LINKS & REFERENCES

© 2022 Instant Accept, LLC. All rights reserved.

© 2022 Intuit Inc. All rights reserved. Intuit & QuickBooks are registered trademarks of Intuit Inc.

©2018 Google LLC All rights reserved. Google and the Google logo are registered trademarks of Google LLC.