Transactions

Transactions

With Instant Accept, Merchants ARE NOT limited to accepting transactions on the device that runs QuickBooks® – usually a desktop PC. More importantly, customers are not limited either.

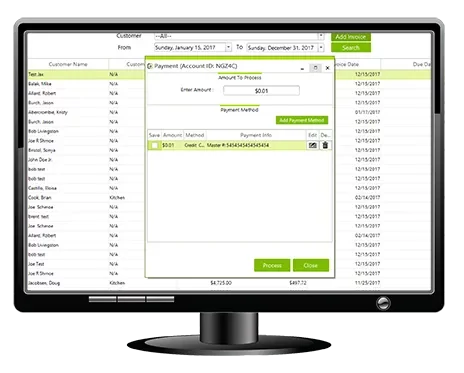

Process and Record Payment Transactions

However you do business, Instant Accept makes it easy to keep customer payments synchronized with QuickBooks. Through Instant Accept’s single user interface or point of sale (POS), merchants are able to process and record payment transactions from multiple payment sources and assign a payment to a QuickBooks® invoices without ever opening QuickBooks. Behind the scenes, Instant Accept takes care of the details. Within the Instant Accept User Interface you can.

- create new customer accounts

- create new invoices

- update accounts as needed

- generate reports in real time

Who’s Liable?

On October 1st, 2015, liability associated with the fraudulent use of counterfeit cards shifts from the card issuer to the acquirer – who is universally expected to shift that liability to the merchant. This shift only applies to merchants that have not implemented an EMV-enabled payment solution. Merchants are only liable for the amount of the fraudulent transaction. It does not affect the merchant’s liability pertaining to data breaches or ‘card not present’ (ecommerce) transactions – where the bulk of stolen cards are used.

For this reason, many merchants who have little risk of fraudulent transactions will likely wait to move to EMV until they’re due for a new Point of Sale, if at all. It’s important to understand that it is not a mandate, just a liability shift. POS providers should be taking on a consultative role to help their merchants determine whether the move to EMV is a good fit for their business.

Synchronize Your Data

- Website

- Mobile Phone

- Tablet

- Point of Sale (POS) Systems and Terminals

- and virtually any other device.

Keep Your Financial and Customer Payment Data Secure and Private

A transaction is more than a purchase. It’s also a sign of trust. QuickBooks® also stores your customers’ credit card information on the same local hard drive. And regardless of your QuickBooks® account being password protected, this is not PCI-compliant. If someone breaks into your system, your customers’ credit card information is vulnerable — and you’ll be held accountable.

With Instant Accept, your sales associates process transactions and accept payments without ever opening QuickBooks®, keeping your company’s financial data secure and private. In addition, the payments you process with Instant Accept’s payment gateway integration are completely PCI-compliant. Instant Accept stores all payment information directly in the gateway – not on your PC – keeping unauthorized users from accessing critical customer, credit card, and banking information at the point of sale.