Newsletter: July 2020 – Recurring Billing

- Features

- Enhancements

- Tips & Tricks

- Small Business Resources

JULY 2020

INSTANT ACCEPT FEATURE OF THE MONTH

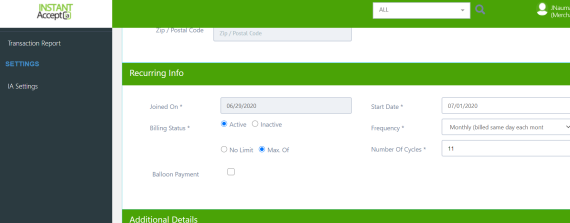

Businesses Can Increase Profits with Recurring Billing

INSTANT ACCEPT TIPS, TRICKS & TOOLS

FEATURED RESELLER

FEATURED MERCHANT

SEND US A REVIEW

If it’s anything below 5 stars contact us so we can work to resolve any issues you may be having.

FEATURED ARTICLE AND INDUSTRY NEWS

A New Alternative to the Paycheck Protection Program (PPP)

Although the Paycheck Protection Program (PPP), created by the Small Business Administration under the Cares Act, was successful it came with its own issues. The long-awaited alternative program has come with several delays but has finally been opened. The new lender portal was created by the Federal Reserve’s Main Street Lending Program.

The difference between the PPP by the SBA and the new alternative offered by the Federal Reserve is the PPP is forgivable as long as you follow all of the guidelines and the alternative is not forgivable. The term of the loan was increased from four (4) years to five (5) years but the loan sizes, however, have been reduced from $500k to $250k. The alternative loan has been created for small and mid-sized businesses where the Paycheck Protection Program was created for large and mid-sized businesses.

Each program comes with its own positives and negatives so if you are in the need for financial help for your business click the read more button to start learning a bit more about the alternative. And always remember do your research for what best fits your needs.

- Hierarchy > Merchants – Notifications tab – Select and Save Recipients

- Hierarchy > Merchants > Users tab – Resend Welcome Email Button

Virtual Terminal

- Added Switch Account feature for multiple concurrent logins

- Hierarchy > Add / edit entities – Billing Info tab – Put label ‘Account Holder Type’ for ACH method

- Improved success and error messages when all 10 invoices of a page are emailed altogether using single Email Invoices button

WHAT’S NEW

- Convenience Fee support in Invoices and Sales Receipts (Screenshot)

Ability to Store Multiple CC / ACH Profiles for a Customer

KEY FEATURES OF INSTANT ACCEPT

- Choose ANY Processor

- Accept Multiple Forms of Payments

- Work Within One User Interface

- Gateway Sync

- Multi-store Locations, Websites and Devices

- Create and Email Invoices

- Purchase Card Level 2 & 3

- Tokenization

- Recurring Payments

- Convenience Fees

- Protect Core Data

- PCI Level 1 Certified

SMALL BUSINESS TIPS & RESOURCES

ACCOUNTING TIPS

What Is Your Small Business Missing?

BUSINESS TIPS

A Few Things to Consider

HELPFUL LINKS & REFERENCES

© 2020 Instant Accept, LLC. All rights reserved.

© 2020 Intuit Inc. All rights reserved. Intuit & QuickBooks are registered trademarks of Intuit Inc.

©2018 Google LLC All rights reserved. Google and the Google logo are registered trademarks of Google LLC.