Newsletter: January 2023 – Fraud Prevention

| Thank you for Signing Up |

January 2023

INSTANT ACCEPT FEATURE OF THE MONTH

Fraud Prevention and Tools

Cybercriminals are more sophisticated than ever when it comes to conducting fraudulent transactions and accessing sensitive credit card data. With this increase, Instant Accept created our FRsK First™ product that helps merchants mitigate fraud. The Instant Accept payment gateway coupled with the QuickBooks integration helps keep merchants data and transactions safe and secure all in one place. Instant Accepts fraud prevention suite offers a vast selection of fraud tools for any merchant. Best of all, merchants can choose which tools they would like to turn on and off. To find out more about what the fraud suite has to offer continue reading on.

INSTANT ACCEPT TIPS, TRICKS & TOOLS

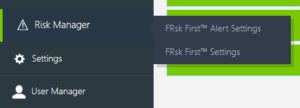

Frsk FirstTM Risk Manager

Small Businesses Should be Proactive on Fraud

Business News Daily has published a comprehensive guide to help businesses, particularly small businesses, to understand payment fraud and how to handle it within their business. They walk through several items to help technical and nontechnical small business owners understand payment fraud and how to be proactive to work towards avoiding it and defending themselves, their business, and their customers. According to Business News Daily a LexisNexis report states that for every $1 in fraud can cost businesses around $3.99. Which is a very significant amount of money for small businesses.

Protect Your Business and Your Customers Now

Don’t Underestimate Your Own Risk of Fraud

Don’t ignore the possibilities of fraud within your business. Small businesses are more likely to have issues with fraud because of their business size. From the report of the Association of Certified Fraud Examiners (ACFE), they have found that employees within the business can be one of the main causes of fraud. They have also come up with many options and pointed out vulnerabilities that you can look at within your business to protect your business and your customers now.

KEY FEATURES OF INSTANT ACCEPT

WE WOULD LOVE YOUR FEEDBACK

- Choose ANY Processor

- Accept Multiple Forms of Payments

- Work Within One User Interface

- Gateway Sync

- Multi-store Locations, Websites and Devices

- Create and Email Invoices

- Purchase Card Level 2 & 3

- Tokenization

- Recurring Payments

- Convenience Fees & Surcharging

- Protect Core Data

- PCI Level 1 Certified

Click the button and send us a review. If it’s anything below 5 stars contact us so we can work to resolve any issues you may be having.

HELPFUL LINKS & REFERENCES

© 2023 Instant Accept, LLC. All rights reserved.

© 2022 Intuit Inc. All rights reserved. Intuit & QuickBooks are registered trademarks of Intuit Inc.

©2018 Google LLC All rights reserved. Google and the Google logo are registered trademarks of Google LLC.